Investment Adviser Makes the Most of a Mock SEC Exam

"Having worked with Ann Oglanian in the past, I expected nothing less than the high level of professionalism and work quality we received. ReGroup made the mock SEC audit real for us. It was a great learning experience and the feedback we received was incredibly valuable as it was sensitive to our firm’s unique situation and perceived risks."

Doug P., Chief Compliance Officer

Read More

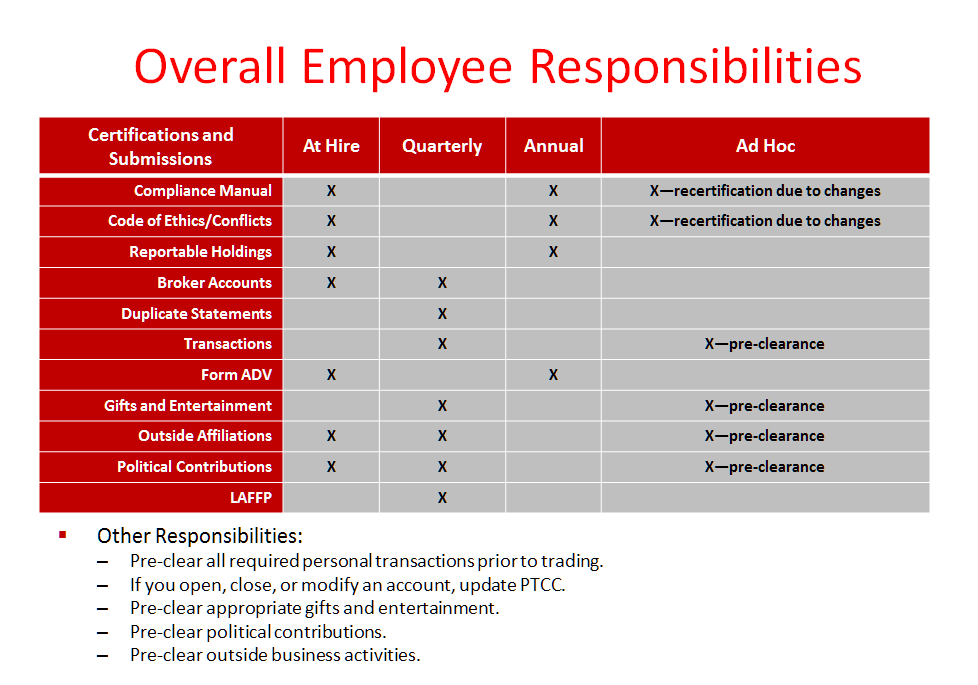

Developing a Code of Ethics Program

Facing increased due diligence from institutional investors, the CEO of a $2B SEC registered investment adviser sought to establish a code of ethics program.

Read More

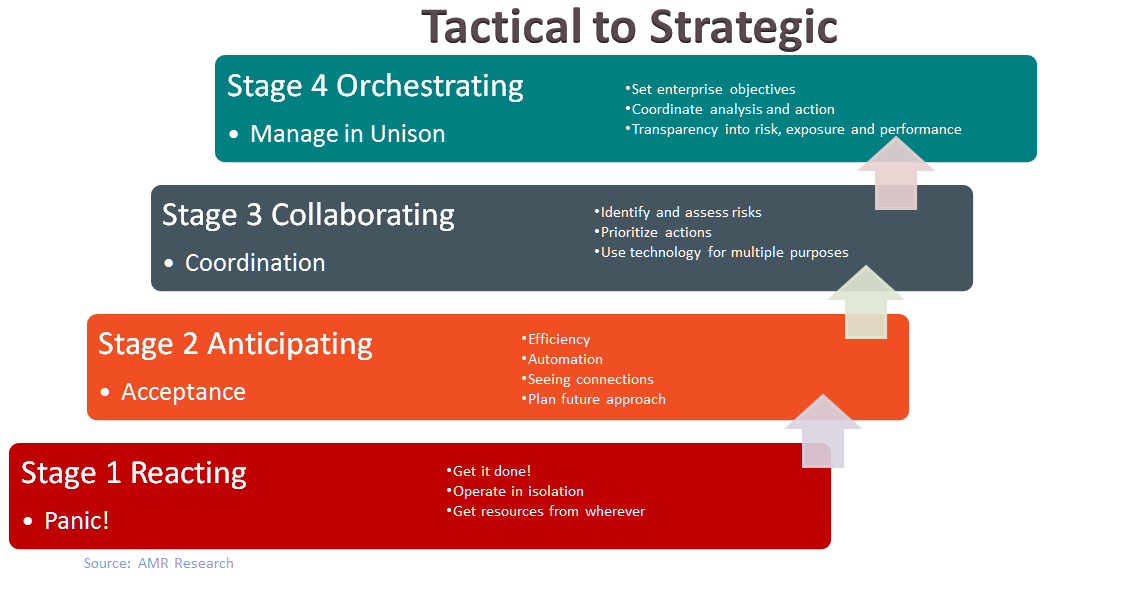

Compliance Department Strategy

A multinational insurance company managed $70B AUM in captive assets of its parent company and global affiliates.

Read More

Risk Governance for An Investment Adviser

“In order to do risk management well, you need to understand the business. ReGroup understands the business. ReGroup helped us understand the depth we needed to go to make sure the right framework was in place – that was our safety net.

Jayne E., Senior Portfolio Manager

Read More

A Hedge Fund Uses a Compliance Committee to Manage Risk

"This committee and Ann’s involvement as an independent compliance expert have become an invaluable resource to the firm and an integral part of our risk management efforts."

Peter G., Chief Compliance Officer and General Counsel

Read More

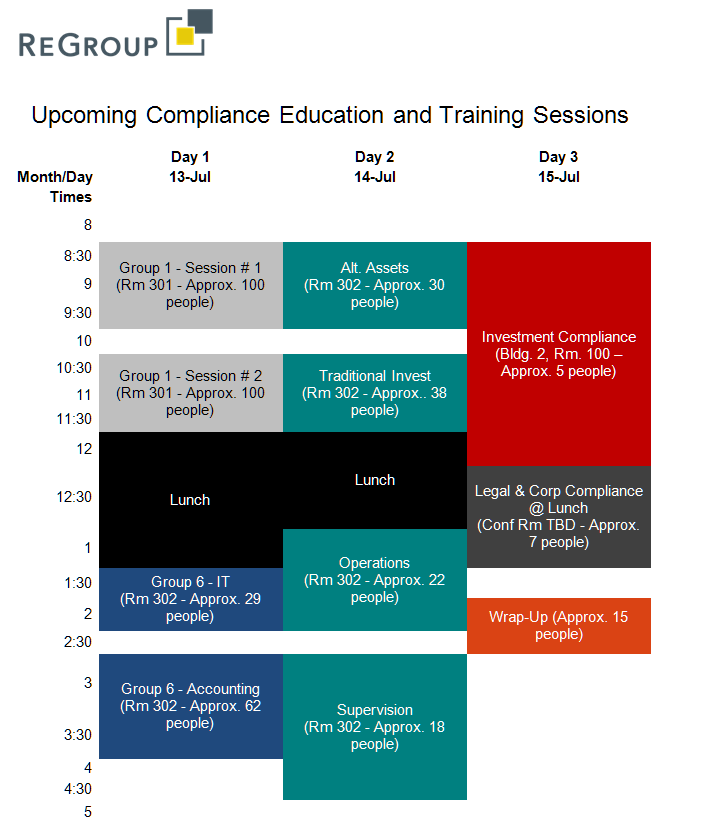

Establishing Relevant, Risk-Responsive Compliance Education

A mid-sized registered investment adviser’s compliance testing revealed the need for a clear, consistent compliance training program for both new and current employees.

Read More

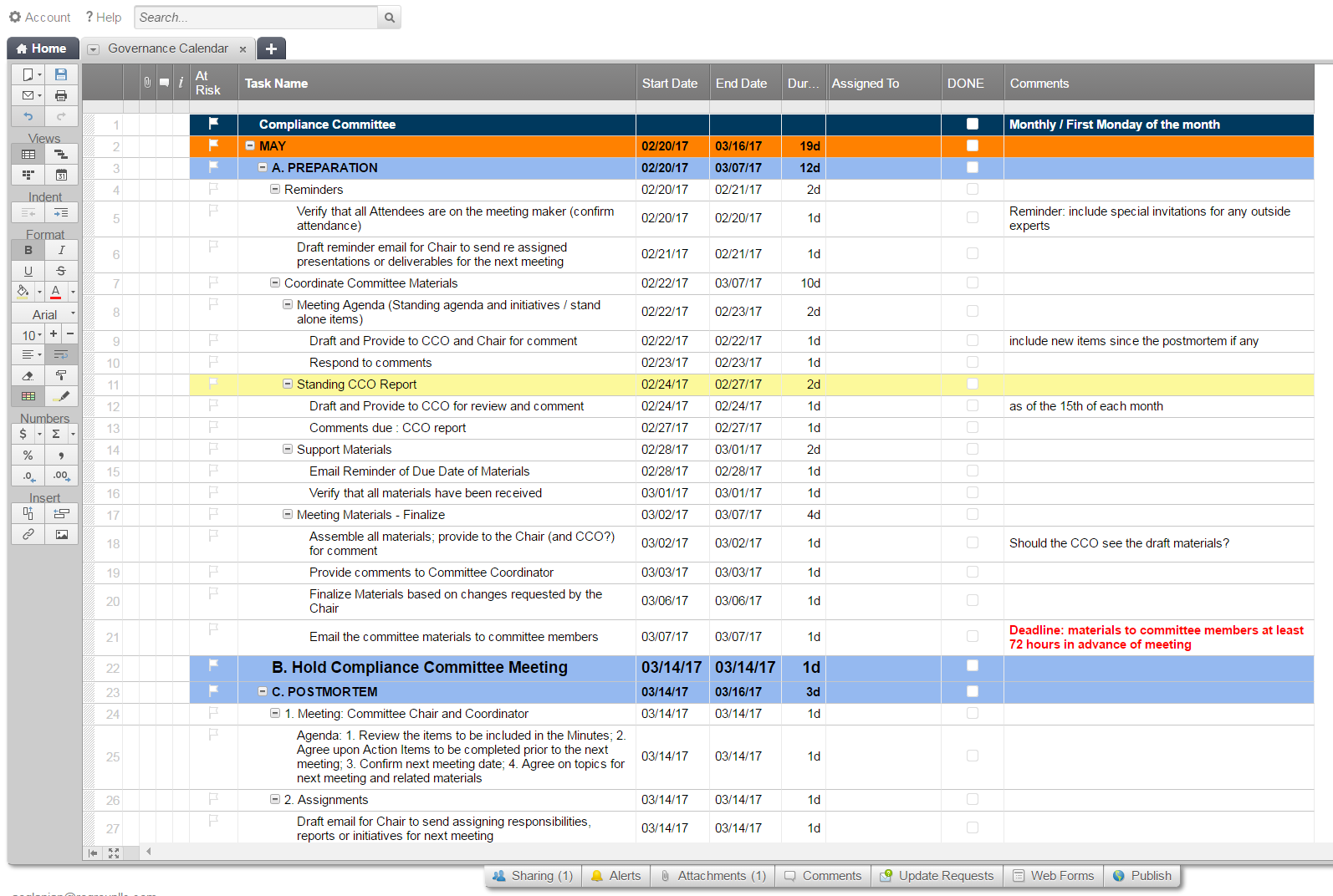

Efficiency Gains and Risk Management with Simple Systems

A small cap manager with 4 billion AUM, a twenty-year operating history, and 18 employees, sought to capture repeatable tasks, regulatory requirements and client deadlines, and to create clearer reporting to senior leaders.

Read More

Code of Ethics Administration & System Utilization

In order to improve its operational efficiency, a $2B SEC-registered private fund manager purchased and implemented a compliance management system to assist in the administration of the firm’s code of ethics.

Read More

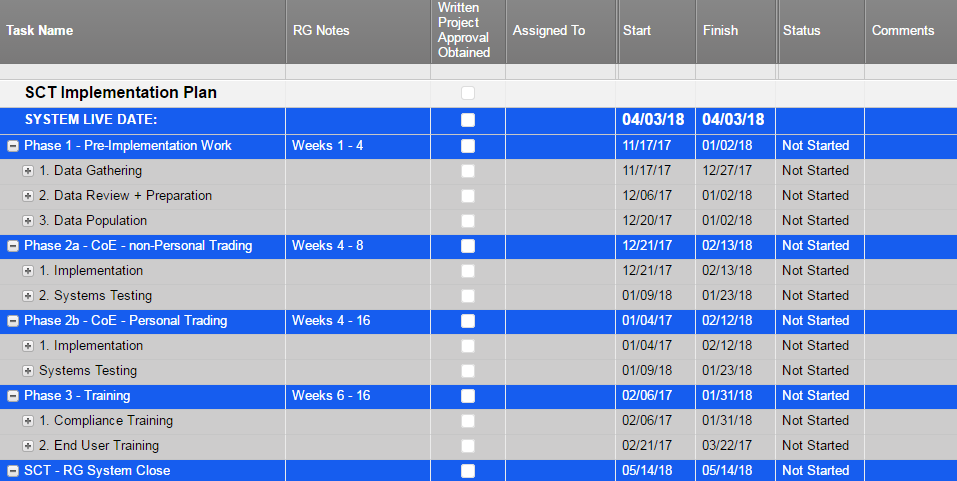

Implementing a Compliance Management System

“Working with ReGroup removed the guesswork from our compliance systems implementation. ReGroup managed the risk of investing in a system with outstanding project management and delivered a huge asset to our firm on time and on budget.”

Todd S., Chief Compliance Officer

Read More

Independent Review of Compliance Program Design

"I trust ReGroup implicitly. I know they are on the right track, and I know enough about compliance to know this. Everything they uncovered has been pointed out for a good reason."

Robert L., President and CEO

Read More

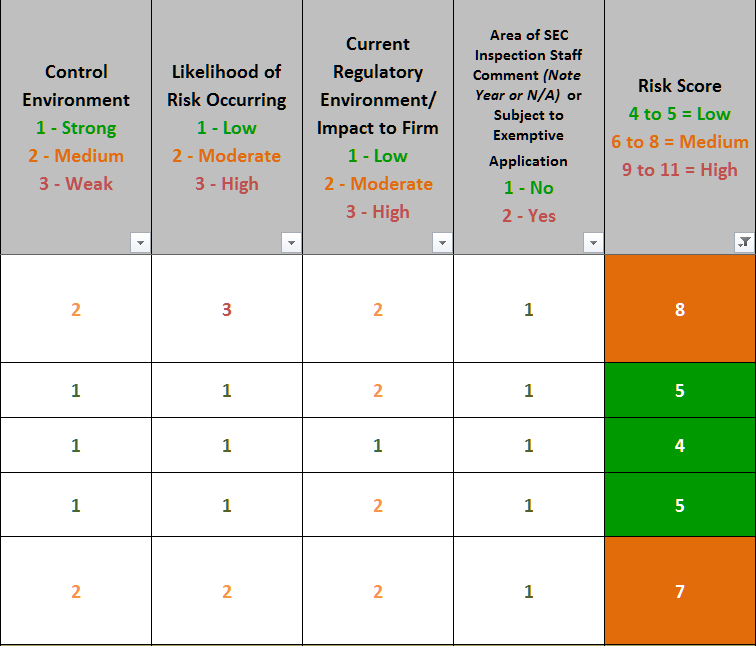

Regulatory & Operational Risk Management

The CCO of a $7B AUM investment adviser requested assistance managing the firm’s compliance program and testing plan in a way that assessed, incorporated, and mitigated regulatory and operational risk.

Read More