Head Trader: Changing Expectations For Alpha Generation

OPPORTUNITY

The pending retirement of the head trader of boutique institutional investment manager caused the partners to ask what qualities they would seek in his replacement.

The firm suspected that, given its significant growth in AUM and the potential for greater product complexity, the expectations and requirements for the head trader role had shifted considerably. The partners wished to use the new hire as an opportunity to redefine the role's responsibilities, skill sets, and reporting line.

Importantly, the partners wanted to know how their competitors were using traders to help generate alpha, and the firm engaged ReGroup to assess their needs, and create a new expectation for the role of a head trader advance of their search.

PROCESS

ReGroup began with a working premise that more alpha generation and leadership could be expected from the Head Trader role.

We analyzed the current head trader role, taking into account the current head trader's strengths, weaknesses, and overall performance alongside the firm's infrastructure, organization, investment strategies, business objectives, and risk profile.

ReGroup then conducted original research and interviewed head traders from buy-side advisers throughout the US and Canada to collect trends and takeaways specific to our client's trading activity, geographic location, technology requirements, and alpha-generation expectations.

ReGroup worked with the firm's partners, including the investment staff, to form a consensus about the firm's needs.

RESULTS

ReGroup provided a detailed blueprint of the Head Trader 2.0 role, which included the evolution of the firm's head trader role designed to guide the firm's discussion and, ultimately, their hiring strategy.

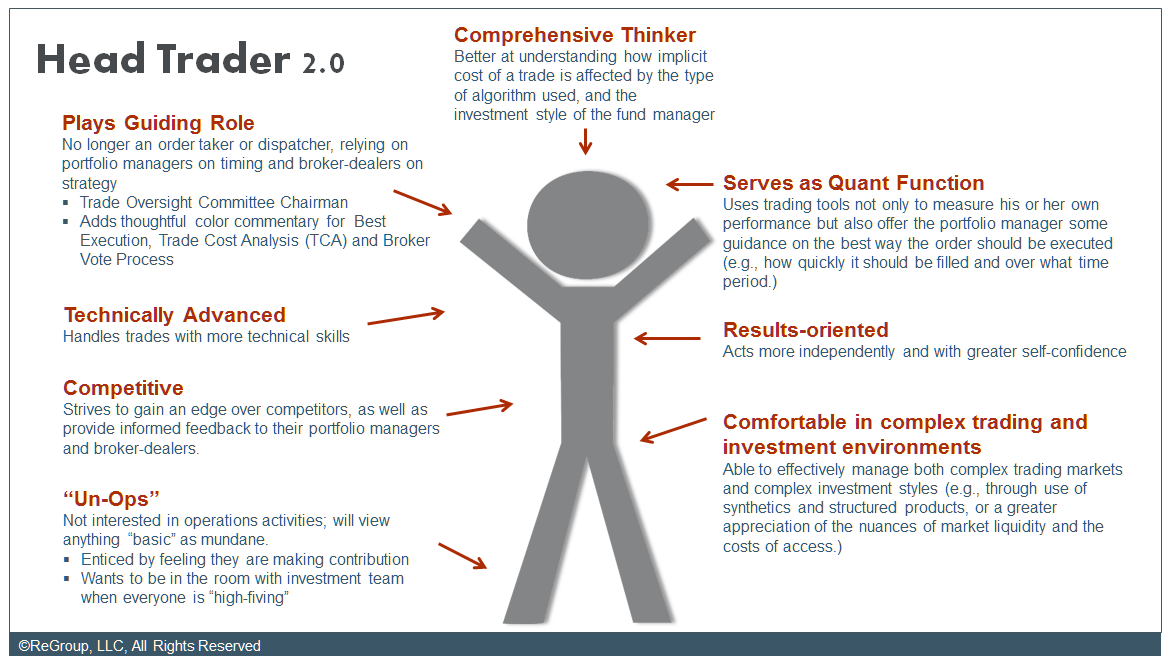

Based on interviews with notable Head Traders and independent research, ReGroup redefined the Head Trader 2.0 role. Notable 2.0 characteristics include a dedication to supporting alpha generation through a passionate and broad market monitoring, expert communication skill, a facility for working directly with portfolio managers, and a deep understand the potential impact of trading from multiple points of view.

The blueprint outlined the manner in which the firm could elevate the head trader position, and related expectations, to support the firm’s long-term investment performance and effectively support increasingly complex client inquiries. A 2.0 Head Trader will be able to:

- Effectively manage both complex trading markets and investment styles, while appreciating market liquidity and related costs;

- Utilize trading tools to not only measure his or her own performance but also to offer the portfolio manager guidance on the best order execution within constrained market liquidity and cost pressures;

- Think comprehensively about the markets, and offer credible insights that impact alpha generation over time;

- Actively advise on tactical execution in the context of the broader investment strategy. strategies and communicate effectively with the portfolio managers and clients;

- Actively participate in regular team meetings and produce, as appropriate, written communications and updates on companies in the portfolio or for consideration in the portfolio.

As a result of the Head Trader 2.0 Blueprint, the client engaged ReGroup to conduct a search for a new Head Trader to succeed to the role of their retiring Head Trader, and to elevate the role to participate in alpha generation.